Carregando...

Carregando... Carregando...

Carregando...

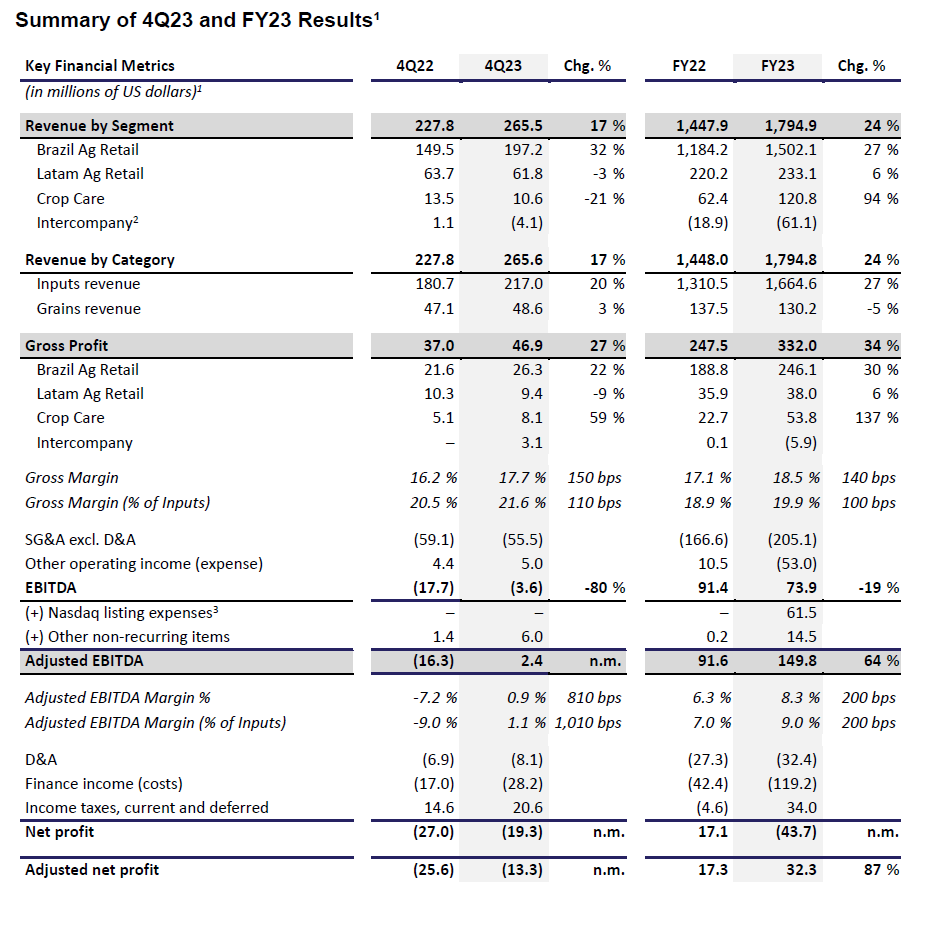

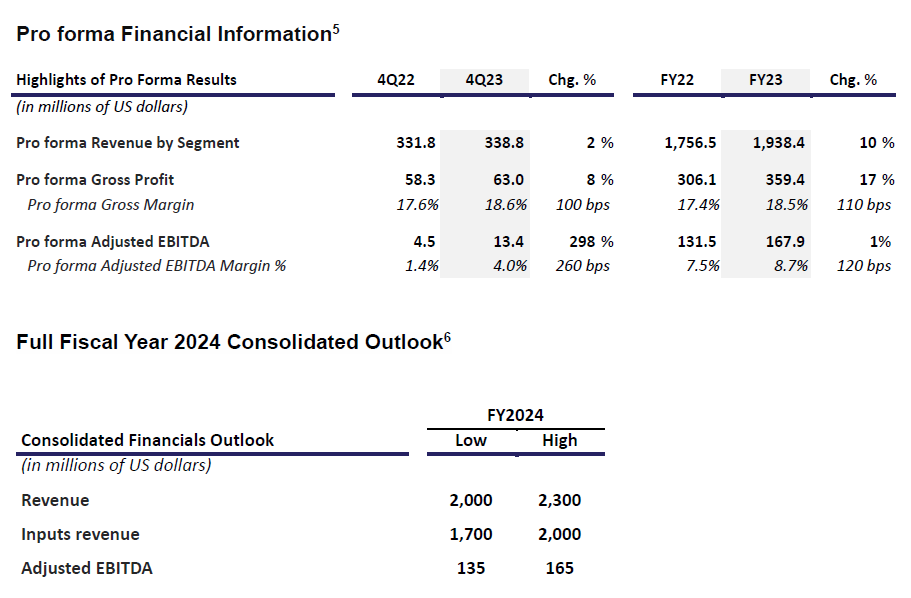

• Lavoro’s revenue reached $1.8 billion for the FY2023, marking a 24% increase compared to the previous year

• FY2023 gross profit was $332 million, up 34% y/y, with gross margins expanding 140 bps to 18.5%

• Lavoro successfully completed the acquisition of Referência Agroinsumos on July 31, 2023, further expanding its retail presence in the State of Rio Grando do Sul in the South of Brazil. Referência serves over 2,000 farmers, and brings an additional 25 technical sales representatives (RTVs) to the Lavoro family.

• On June 30, 2023, Lavoro announced a partnership with Stenon, which will enable us to offer accurate real-time soil analysis to our farmer clients, helping their decision-making and leading to improved agronomic outcomes

Lavoro provides its FY2024 outlook, expecting consolidated revenue in the range of 2.0 to 2.3 billion, consolidated Inputs revenue in the range of $1.7 to 2.0 billion, and consolidated Adjusted EBITDA in the range of $135 million to $165 million. SÃO PAULO – November 1, 2023 (GLOBE NEWSWIRE) — Lavoro Limited (Nasdaq: LVRO; LVROW), the first U.S.-listed pure-play agricultural inputs distributor in Latin America, today announced its financial results for the fiscal fourth quarter, ended on June 30, 2023.

“In recent months, we saw a further worsening in pricing trends in crop protection and fertilizers, as significant global pricing declines were exacerbated by excess channel inventories in Brazil, particularly in herbicides. While we are seeing signs of stabilization of the pricing trends, our expectation is for the retail ag inputs in Brazil to see overall decline of approximately -20% for our fiscal year 2024, led by these pricing headwinds. With that said, our view is that the fundamentals long-term secular growth drivers for our Brazil Ag Retail segment have not changed. What we have been witnessing in the past few quarters is simply the normalization of input prices that overshot in ’21-’22 as a result of temporary factors that have now waned, namely the impact of COVID-led plant shutdowns on Chinese agrochemical production, and the effects of the War in Ukraine. We view this as a temporary effect that we expect should not persist beyond the end of this our fiscal year, and should not affect our long-term growth algorithm. ” commented Ruy Cunha, CEO of Lavoro.

“Our scale, regional and product diversification, vertical integration with Crop Care, strong balance sheet, M&A capabilities, and ability to invest in technology and new services, sets us apart relative to the rest of industry. We believe we are uniquely positioned to capitalize on the current environment, accelerate our market share gains and improve our financial performance as market conditions normalize.” added Mr. Cunha.

4Q23 Financial Highlights

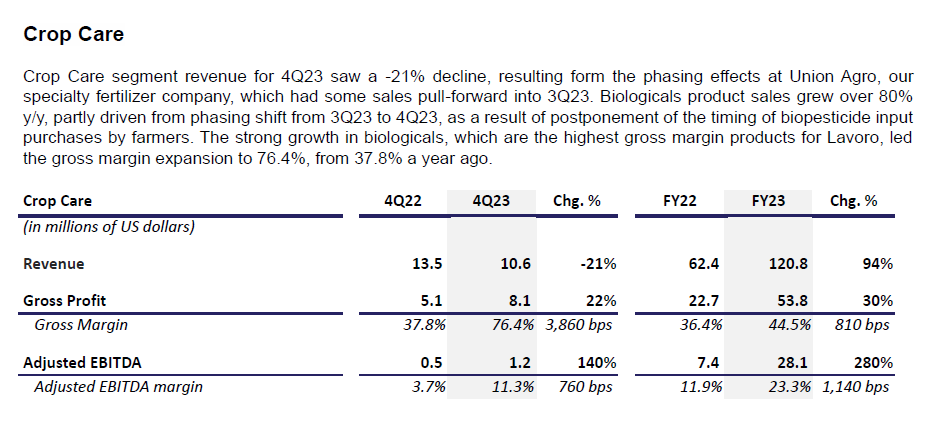

Segment Results for 4Q23 and FY234

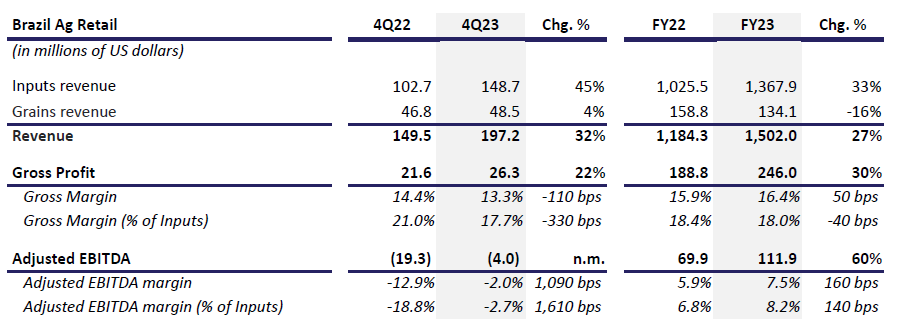

Brazil Ag Retail

Segment revenue increased by 45% to $197 million in 4Q23, with strong unit volume growth in crop protection, fertilizer and specialty sales, more than offsetting steep price declines that the industry witnessed over the past few months. Gross margin decreased by 110 bps to 13.3%, owing to these pricing headwinds, partly offset by a previously planned $12 million supplier renegotiation benefit.

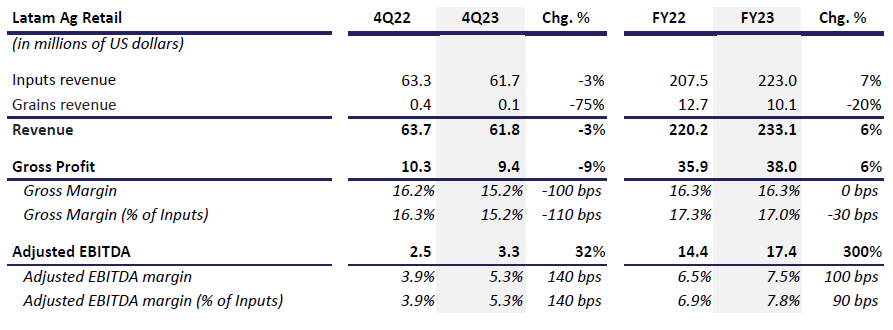

Latam Ag Retail

The segment grew 10% on a constant currency basis (Colombian peso), primarily strong sales in specialties and corn seeds, partly offset by headwinds resulting from the removal of Paraquat, a financially relevant herbicide, from the product lineup one of our suppliers. The devaluation of the peso was a -13% y/y negative contributor, with revenue declining -3% on a US dollar basis. Gross Margin contracted by 100 bps in 4Q23, reflecting the deflationary pricing trends in crop protection and fertilizers.

Recent Business and Commercial Updates

Partnership with Stenon

On June 30, 2023, Lavoro announced a partnership with Stenon. Stenon is a step-change evolution in soil chemistry testing, with its FarmLab solution, which is a portable sensor-based devices enabling accurate real-time analysis of Nitrogen and other agronomically relevant soil indicators. With Stenon, as a practical example, our RTVs will be able to provide clients with timely recommendations for nitrogen application across their corn planting area, resulting in improved costs and crop yields. We are planning to sample 100,000 acres in the coming crop season across the state of Parana, where 100 RTVs have been trained and are ready to execute on this service.

Recent M&As Updates

Closed agreements

Referência Agroinsumos

On July 31, Lavoro successfully completed the acquisition of a controlling interest in Referência Agroinsumos. Founded in 2006, Referência has nine distribution locations and more than 80 employees, serving approximately 2,000 customers in the South of Brazil.

Conference Call Details

The Company will host a conference call and webcast to review its fiscal fourth quarter 2023 results on Wednesday, November 1, 2023, at 8:30 am ET / 9:30 am BRT.

The live audio webcast will be accessible in the Events section on the Company’s Investor Relations website at https://ir.lavoroagro.com/disclosure-and-documents/events/.

Non-IFRS Financial Measures

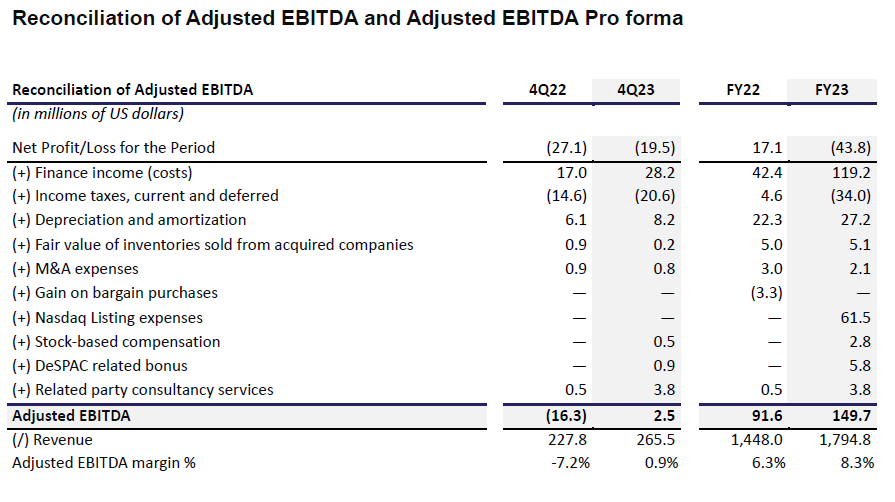

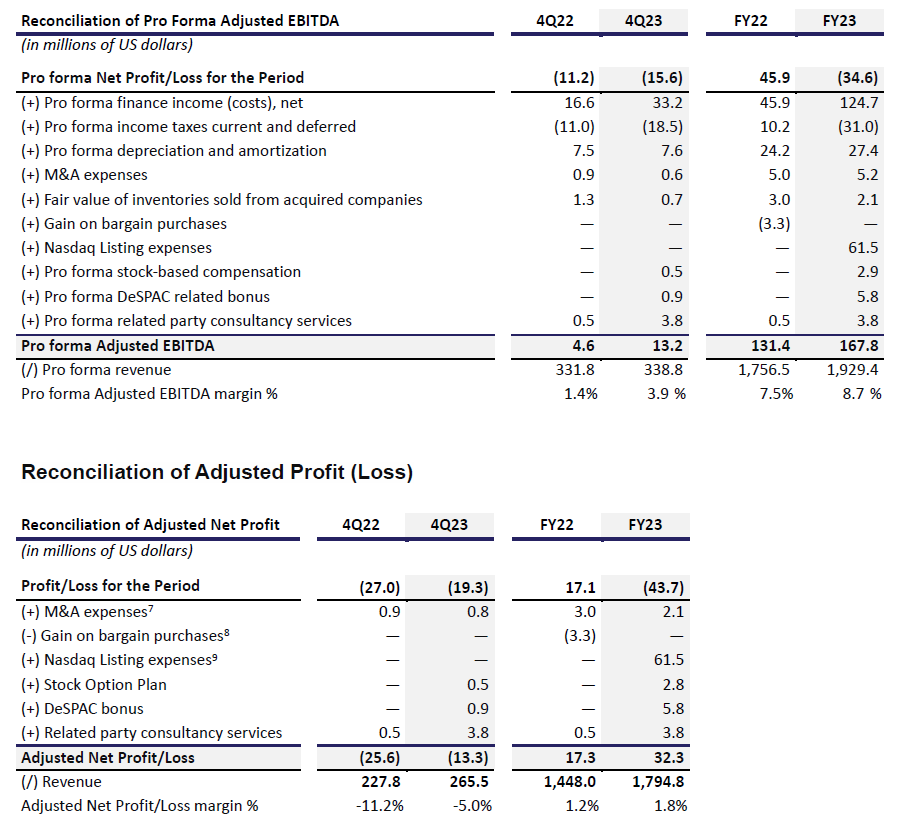

This press release contains certain non-IFRS financial measures, including Adjusted EBITDA, Adjusted EBITDA Margin, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin. A non-IFRS financial measure is generally defined as a numerical measure of historical or future financial performance, financial position, or cash flow that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. The Company believes these non-IFRS financial measures provide meaningful supplemental information as they are used by the Company’s management to evaluate the Company’s performance, and provide additional information about trends in our operating performance prior to considering the impact of capital structure, depreciation, amortization and taxation on our results, as well as the effects of certain items or events that vary widely among similar companies, and therefore may hamper comparability across periods, although these measures are not explicitly defined under IFRS. Management believes that these measures enhance a reader’s understanding of the operating and financial performance of the Company and facilitate a better comparison between fiscal periods. Adjusted EBITDA is defined as profit for the period, adjusted for finance income (cost), net, income taxes current and deferred, depreciation and amortization, M&A expenses that in management’s judgment do not necessarily occur on a regular basis, fair value of inventories sold from acquired companies, minus gain on bargain purchases, to provide further meaningful information to evaluate the Company’s performance. Adjusted EBITDA Margin is calculated as Adjusted EBITDA as a percentage of revenue for the period. Pro Forma Adjusted EBITDA is defined as pro forma profit for the period, adjusted for pro forma finance income (costs), net, pro forma income taxes current and deferred, pro forma depreciation and amortization, fair value on inventories sold from acquired companies, and M&A expenses that in management’s judgment do not necessarily occur on a regular basis, minus gain on bargain purchases. Pro Forma Adjusted EBITDA Margin is calculated as Pro Forma Adjusted EBITDA as a percentage of pro forma revenue for the period.

The Company does not intend for the non-IFRS financial measures contained in this release to be a substitute for any IFRS financial information. Readers of this press release should use these non-IFRS financial measures only in conjunction with comparable IFRS financial measures. Reconciliations of the non-IFRS financial measures, Adjusted EBITDA, and Pro Forma Adjusted EBITDA, to their most comparable IFRS measures, are provided in the table below.

About Lavoro

Lavoro is Brazil’s largest agricultural inputs retailer and a leading producer of agricultural biological products. Lavoro’s shares and warrants are listed on the Nasdaq stock exchange under the tickers “LVRO” and “LVROW.” Through its comprehensive portfolio of products and services, the company empowers small and medium-size farmers to adopt the latest emerging agricultural technologies and enhance their productivity. Since its founding in 2017, Lavoro has broadened its reach across Latin America, serving 72,000 customers in Brazil, Colombia, and Uruguay, via its team of over 1,000 technical sales representatives (RTVs), its network of over 210 retail locations, and its digital marketplace and solutions. Lavoro’s RTVs are local trusted advisors to farmers, regularly meeting them to provide agronomic recommendations throughout the crop cycle to drive optimized outcomes. Learn more about Lavoro at ir.lavoroagro.com.

Reportable Segments

Lavoro’s reportable segments are the following:

Brazil Cluster (Brazil Ag Retail): comprises companies dedicated to the distribution of agricultural inputs such as crop protection, seeds, fertilizers, and specialty products, in Brazil.

LatAm Cluster (Latam Ag Retail): includes companies dedicated to the distribution of agricultural inputs outside Brazil (currently primarily in Colombia).

Crop Care Cluster (Crop Care): includes companies that produce and import our own portfolio of private label products including specialty products (e.g., biologicals and specialty fertilizers) and off-patent crop protection.

Lavoro’s Fiscal Year

Lavoro follows the crop year, which means that its fiscal year comprises July 1st of each year, until June 30th of the following year. Given this, Lavoro’s quarters have the following format:

1Q – quarter starting on July 1 and ending on September 30.

2Q – quarter starting on October 1 and ending on December 31.

3Q – quarter starting on January 1 and ending on March 31.

4Q – quarter starting on April 1 and ending on June 30.

Definitions

RTVs: refer to Lavoro’s technical sales representatives (Representante Técnico de Vendas), who are linked to its retail stores, and who develop commercial relationships with farmers.

Forward-Looking Statements

The contents of any website mentioned or hyperlinked in this press release are for informational purposes and the contents thereof are not part of or incorporated into this press release.

Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “aims,” “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the expectations regarding the growth of Lavoro’s business and its ability to realize expected results, grow revenue from existing customers, and consummate acquisitions; opportunities, trends, and developments in the agricultural input industry, including with respect to future financial performance in the industry. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lavoro.

These forward-looking statements are subject to a number of risks and uncertainties, including but not limited to, the outcome of any legal proceedings that may be instituted against Lavoro related to the business combination agreement or the transaction; the ability to maintain the listing of Lavoro’s securities on Nasdaq; the price of Lavoro’s securities may be volatile due to a variety of factors, including changes in the competitive and regulated industries in which Lavoro operates, variations in operating performance across competitors, changes in laws and regulations affecting Lavoro’s business; Lavoro’s inability to meet or exceed its financial projections and changes in the consolidated capital structure; changes in general economic conditions, including as a result of the COVID-19 pandemic; the ability to implement business plans, forecasts, and other expectations, changes in domestic and foreign business, market, financial, political and legal conditions; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; costs related to the business combination and being a public company and other risks and uncertainties indicated from time to time in the proxy statement/prospectus filed by Lavoro relating to the business combination or in the future, including those under “Risk Factors” therein, and in TPB Acquisition Corp.’s or Lavoro’s other filings with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Lavoro currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect Lavoro’s expectations, plans, or forecasts of future events and views as of the date of this press release. Lavoro anticipates that subsequent events and developments will cause Lavoro’s assessments to change. However, while Lavoro may elect to update these forward-looking statements at some point in the future, Lavoro specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lavoro’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Contact

Julian Garrido

[email protected]

Tigran Karapetian

[email protected]

Fernanda Rosa

[email protected]